option to tax certificate

Any option to tax does not affect a residential building or. A Tax Certificate serves as an investment proof to receive tax benefits.

India 5th Largest Economy In World Word Population Review Business Tax Company Secretary Economy

A tax lien certificate is a claim against property that has a lien placed upon it as a result of unpaid property taxes.

. Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period. For a copy go to wwwgovuk and enter Notice 742A in the search box. New HMRC guidance and forms take effect on 1 June 2008 for VAT in respect of options to tax land and buildings.

The option to tax is disapplied when the property is leased or sold to a charity that is to use the building for a relevant charitable purpose as described above but not as an office. Unit Linked Insurance Plan ULIP ULIP Life Insurance Plan is one of the most important investment plans in India. By purchasing a life insurance policy the taxpayer can avail of the benefit under the income tax act.

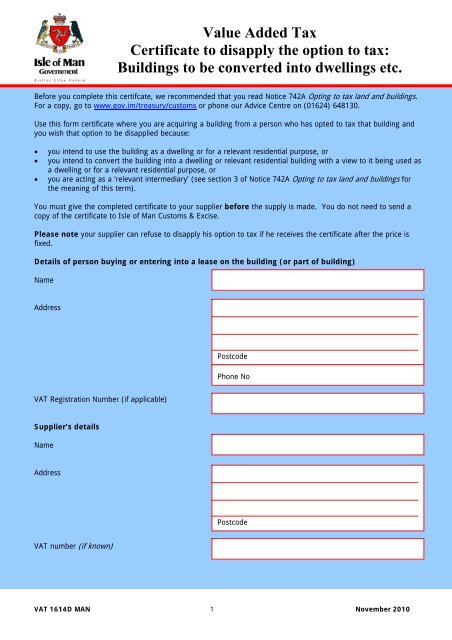

This means that many property owners will have sent their option to tax elections to HMRC and received written confirmation of those options many years ago. How to check your option to tax. Certificate to disapply the option to tax buildings for conversion into dwellings.

There are two parts to the OTT the first is the decision and the second is telling HMRC. Such a disapplication of the option to tax may apply in circumstances where the property is intended to be designed or adapted andor is intended for use as a dwelling or. The VAT treatment of property transactions is a highly complex area of VAT law.

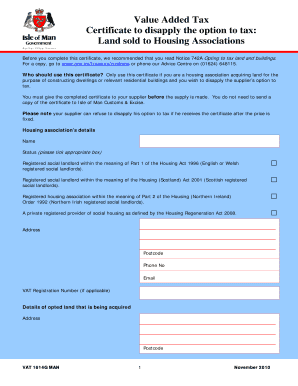

Land sold to Housing Associations Before you complete this certificate we recommend that you read Notice 742A Opting to tax land and buildings. In order to disapply an option to tax the charity would need to issue a certificate. IRDA Direct Broker License.

A government-backed investment plan the Public Provident Fund PPF is primarily used for building a retirement fund. Revoke an option to tax for VAT purposes within the first 6 months Use form VAT1614C for revoking an option to tax land or buildings within. Certificate to disapply the option to tax.

The relevant form to send to HMRCs Option to Tax Unit in Glasgow is VAT1614A which means that the landlord does not need HMRCs. PPF comes with a lock-in period of 15 years. The option to tax rules have been with us a long time since 1 August 1989 to be exact.

Change in Sales Tax Certificates. IRDADB 40708 Code. Where the beneficial and legal interest in a building is split it is the beneficial owner who may opt to tax.

In theory anyone can opt to tax any building. There is now a way HMRC have added this functionality back. The VAT OTT contact details are as follows.

Requirement to provide certificate. With PPF you can claim a tax rebate of Rs 15 Lakh under Section 80C. Before you complete this certificate we recommend that you read Notice 742A Opting to tax land and buildings.

What is the Option to Tax. So in order to claim input tax on the cost of buying and improving the property our landlord must opt to tax it and be VAT-registered so that his rental income is standard-rated taxable rather than exempt. To make a taxable supply out of what otherwise would be an exempt supply.

A charity can also make use of the option to tax where for example it is. Paragraph 33 of Schedule 10 indicates that for option to tax purposes the phrase use for a relevant charitable purpose should be read in accordance with. For guidance with your tax certificate fill in your details and our customer support team will get in touch with you.

You should tell HMRC within 30 days of the effective date of the OTT but HMRC has always had the discretion to allow a longer period. Needless to say the paperwork in many cases will have been lost with the passing of time. A tax lien certificate is a certificate of claim against a property that has a lien placed upon it as a result of unpaid.

Since 1 August 1989 those that hold an interest in a commercial property or land have had the ability to remove the usual VAT exemption that would apply to any use or disposal of that property or land this was always formally referred to as the election to waive exemption but more commonly known as. HMRC has recognised that a disgruntled employee could play havoc by maliciously notifying. The option to tax allows a business to choose to charge VAT on the sale or rental of commercial property ie.

Prior to the Tax Certificate Sale the Tax Collector must advertise the delinquent taxes for three. The option to view your VAT certificate was temporarily removed and as a result many are asking How to view your VAT certificate online. It is not a purchase of propertyFlorida Statutes require the Tax Collector to conduct a sale of tax certificates beginning on or before June 1 for the preceding year of delinquent real estate taxes.

In 1995 it made clear the circumstances in which it will accept a belated notification. For a copy go to wwwhmrcgovuk or phone our advice service on 0845 010 9000. This effectively disapplies the option to tax.

Revoking an option to tax. Effective March 8th 2018 Sales Tax Certificates. New Notice 742A explains to taxpayers the effect of a VAT option to tax a proposed development or piece of land and will help taxpayers decide whether to.

Tax Lien Certificate. It ensures that ones family is financially balanced in the case of an event of death. 2 days agoHeres a list of investment options that can help you save taxes this year.

Some buyers issue a certificate 1614D to the seller prior to sale and this allows the sale to take place without VAT. Use this certificate where you are acquiring a building from a person who has opted to tax that building and you wish that option to be disapplied because. A Tax Certificate is a first lien on property created by payment of the delinquent taxes due.

Call HMRC for help on opting to tax land or buildings for VAT purposes. Call HMRC for help on opting to tax land or buildings for VAT purposes. HMRC - Option To Tax Unit.

Normal due diligence by buyers solicitors should always ask for confirmation proof of option to tax from the vendor. Recently HMRC changed the Valued Added Tax VAT portal for the new Making Tax Digital MTD scheme. But it has no practical effect unless you have an interest in the building you are opting to tax.

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Pin By Sanjeev Sharma On Joining Lettering Life Quotes Career Opportunities

Pin By Ash Prasad On General Fyi Gsm Paper Printer Types Laser Printer

Get Our Printable Resale Certificate Template Letter Templates Certificate Templates Lettering

Deductions Under Chapter Iv A Income Tax Return Life Insurance Premium Tax Deducted At Source

Certificate To Disapply The Option To Tax Isle Of Man Government

Eepc India Members To Get Certificate Of Origin Quickly And Securely Now Get Certificate Certificate Of Origin How To Apply

Ap Deecet 2nd Phase Web Counselling Dates Certificate Verifications At Counseling Dating Certificate

Ap Deecet 2016 Counselling Rank Wise Web Option Process D Ed Admission Certificate Verification Dates Ssc Material Softwares Cgg Counseling Wise Admissions

Get Our Image Of Anger Management Certificate Template Certificate Templates Anger Management Anger

Mortgage Credit Certificate Mortgage Tax Accountant Accounting Services

Browse Our Image Of Non Refundable Rental Deposit Form Template For Free Contract Template Certificate Of Deposit Payment Agreement

Sales Rebate Agreement Template Lera Mera For Volume Rebate Agreement Template 10 Profess Personal Financial Statement Label Templates Certificate Templates

Fillable Online Gov Vat 1614g Man Certificate To Disapply Option To Tax Land Sold To Housing Associations Doc Gov Fax Email Print Pdffiller

Do I Have To Pay Sales Tax What If I Am Tax Exempt Techsmith Support

Member Retirement Timeline And Checklist In 2021 Retirement Timeline Checklist

Do You Need A Beneficial Owner Tax Transparency Certification For Your Bank We Provide An Example Of Ultimate Benefici Certificate Business Template Templates