salt tax deduction news

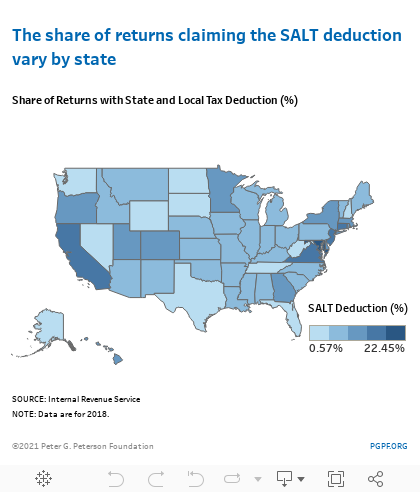

The Supporting Americans with Lower Taxes SALT Act sponsored by US. The cap limits to 10000 the amount of state and local taxes people may deduct on their federal income tax return.

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

December 12 2021 930 AM 4 min read.

. Bill Ackman says that raising the state and local tax deduction -- known as SALT -- to 80000 makes no sense joining the debate over a contentious issue in. Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year.

On April 6 2021 New York Gov. Mikie Sherrill D-NJ conducts a news conference to advocate for inclusion of the state and local tax SALT deduction in the Build Back Better Act reconciliation bill outside the U. State Local Tax SALT The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately stated taxable income or.

SCOTUS swats away SALT cap challenge that limits tax deductions in New York Maryland Four states had challenged the 2017 limit on deductions of state and local taxes. State notwithstanding the federal limit on the amount of state and local taxes individuals can. Paying a state income tax of 10 percent or more.

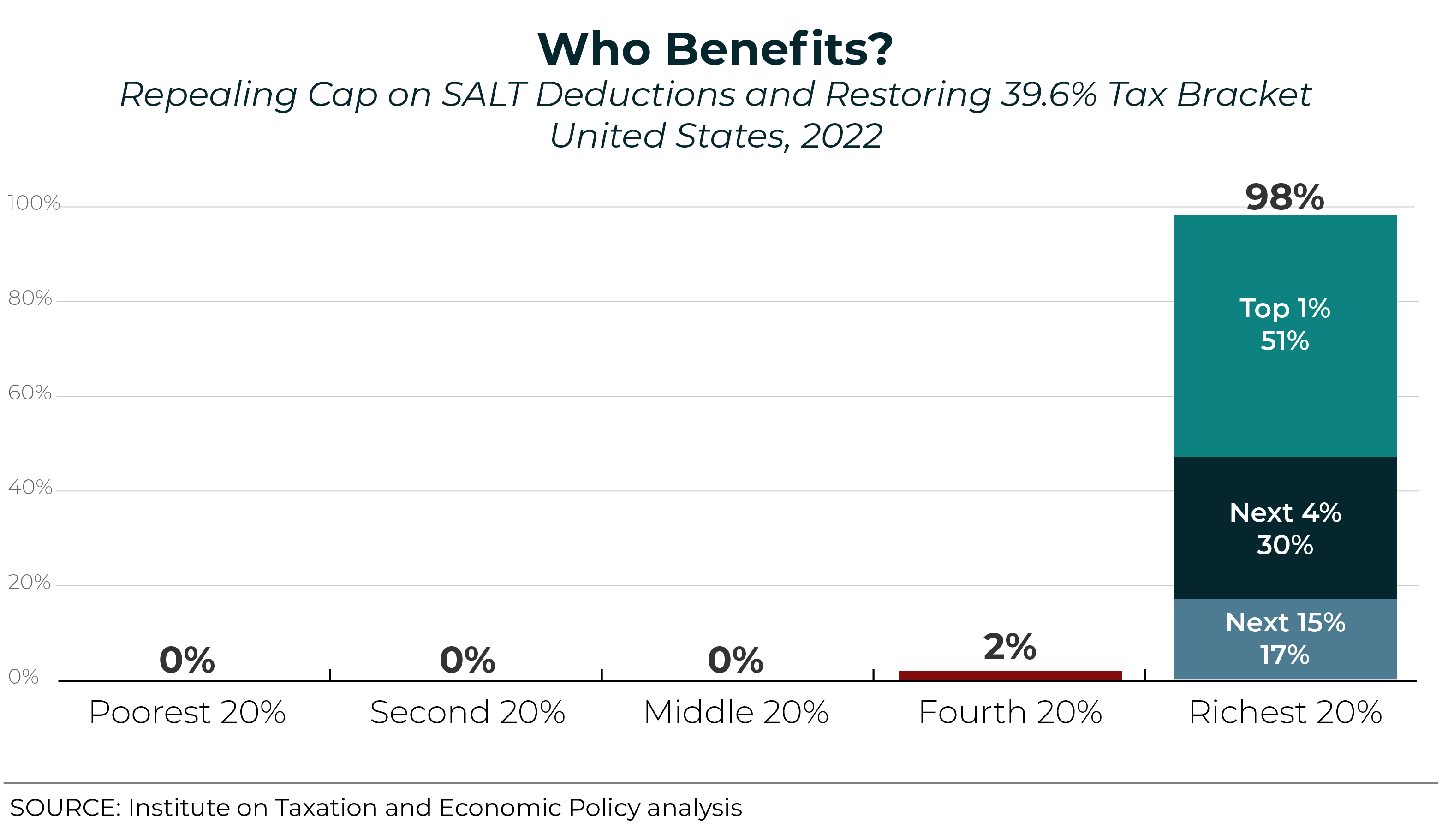

Dems just snuck a tax cut for the rich into. However nearly 20 states now offer a workaround that allows. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT.

The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions. New York Daily News. Erin Cleavenger The Dominion Post Morgantown WVa.

Approximately 125000 Erie County households experienced a tax increase because of the limit placed on the SALT deduction with the average increase reported at 815 a year. December 12 2021 318 PM PST. Tom WilliamsCQ-Roll Call Inc via Getty Images More On.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial provisions of the 2017 tax bill. Josh Gottheimer speaks during a press conference in Englewood on Sept.

SALT Select Developments - April 2022. The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year. That was bad news for top earners in blue states such as California and New York.

Psaki wont rule out tax cuts for wealthy despite Sanders SALT demand Bidens Build Back bill is in worse shape than ever hooray. However many filers dont know. The state and local tax deduction known as SALT will stay capped at 10000 after the US.

Without an extension from Congress the. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year and increase the deduction cap for Americans who make up to 1 million. But the Tax Cuts and Jobs Act limited that deduction to 10000.

New York won a big boost in the so-called SALT tax break along with a river of cash for housing schools and health in President Bidens sprawling. Gottheimer and other members of the New Jersey SALT Strike Team want a full repeal of what they called the. Supreme Court has rejected a challenge to overturn the 10000 limit on the federal deduction for state and local taxes which is known as SALT.

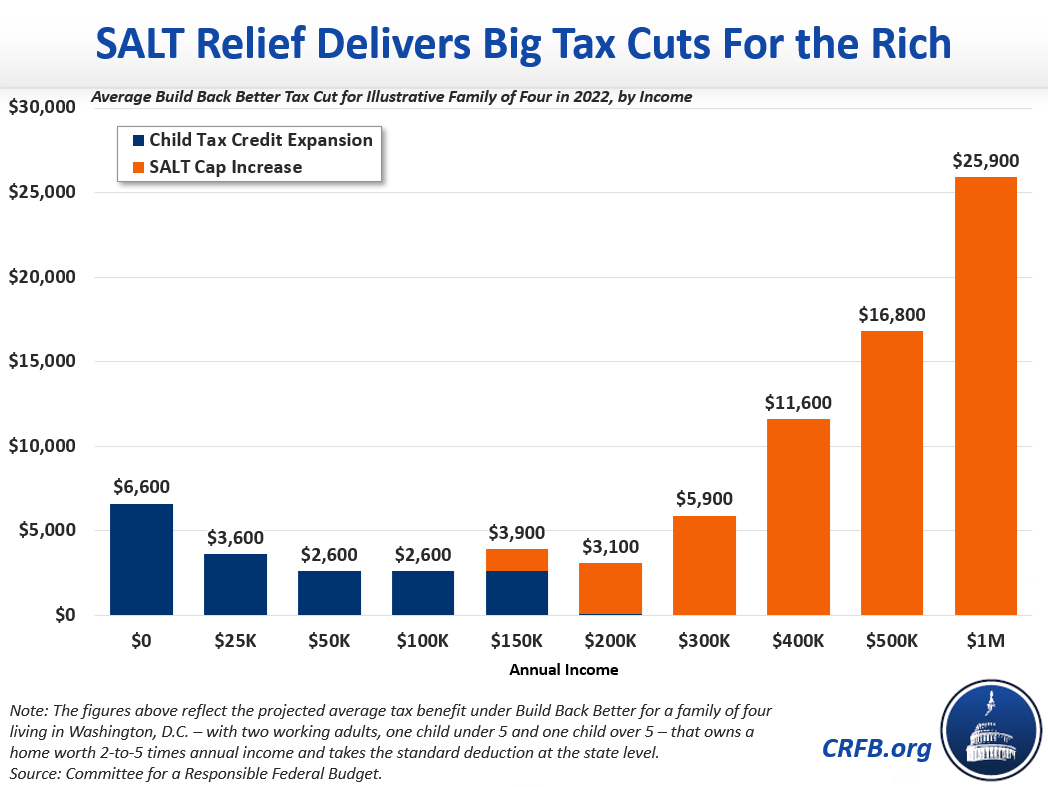

12There has been a lot of discussion amongst government leaders about the cap on state and local. House Democrats 175 trillion spending package boosts the limit on the federal deduction for state and local taxes known as SALT to 80000 through 2030. Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

Nov 19 2021 at 748 PM. Most people do not qualify to itemize. Like the standard deduction the SALT deduction lowers your adjusted gross income AGI.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Why The Debate Over Salt Deductions Matters The Hill

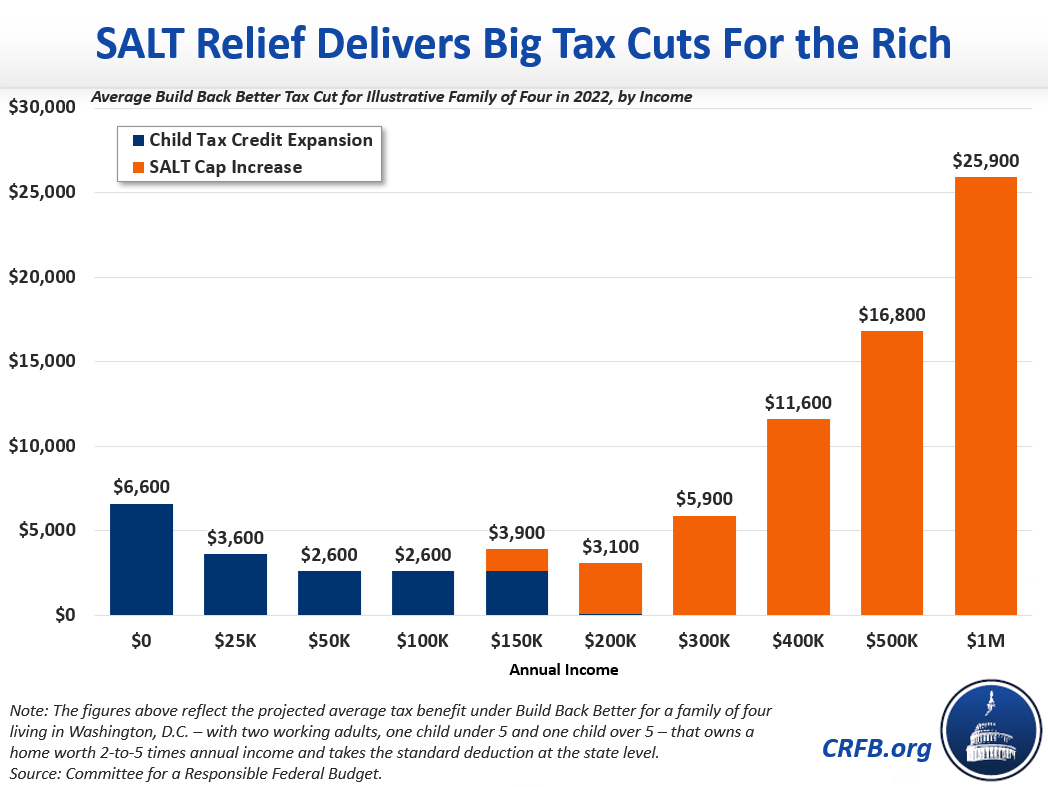

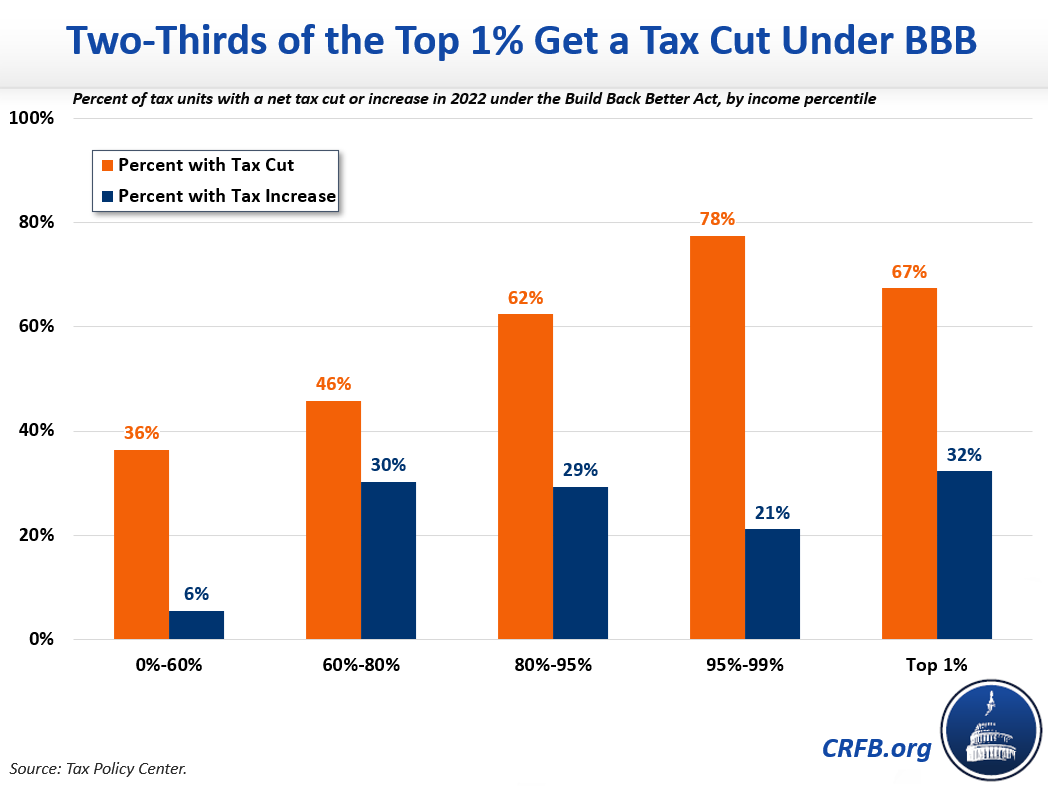

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

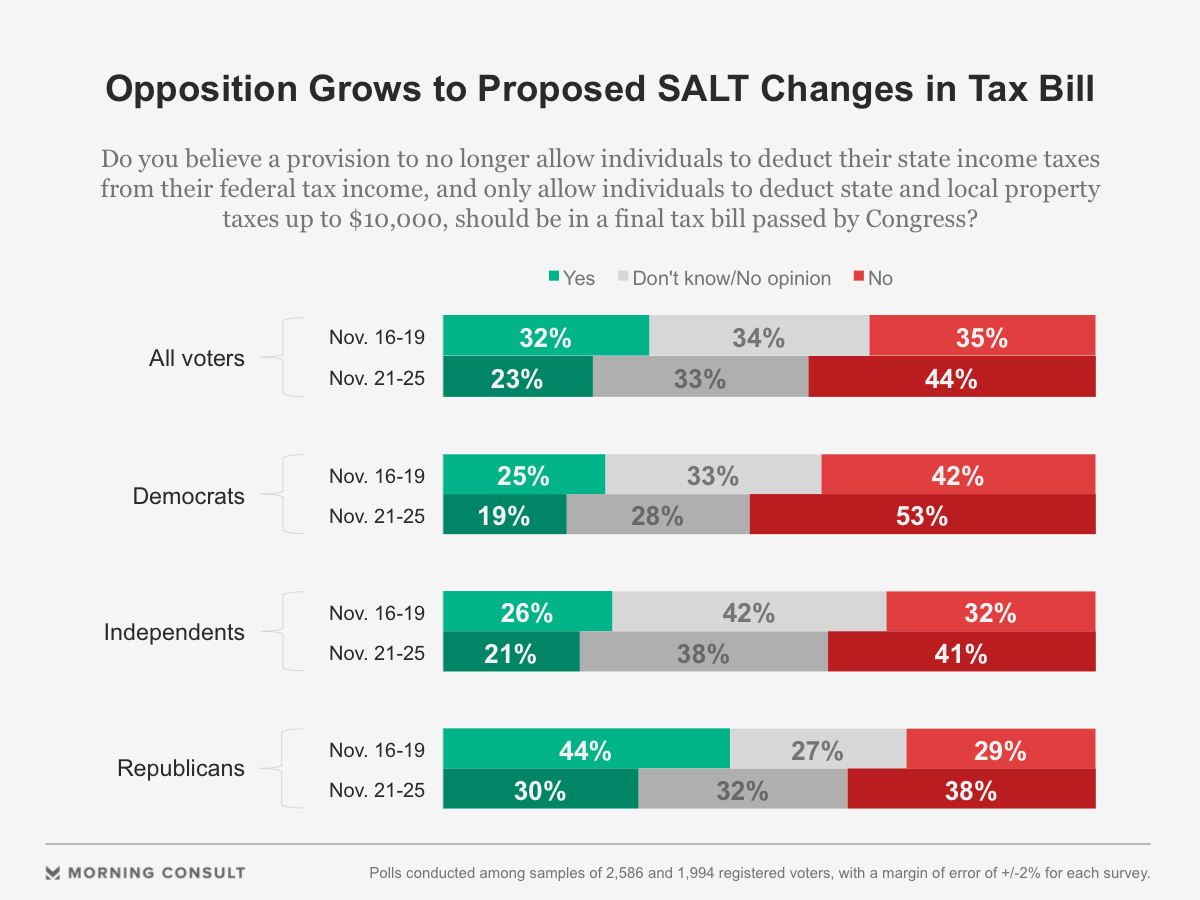

Voters Increasingly Oppose Proposed Salt Deduction Changes

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Who Can Take The New Business Tax Deduction Even Tax Experts Aren T Sure Utica New York Emotional Wellness National Sleep Foundation

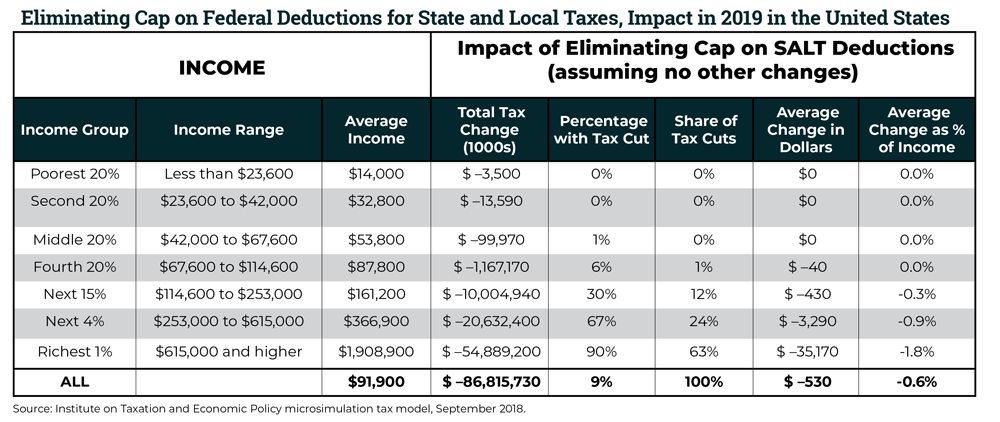

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

2022 Changes To Popular Tax Deductions Cpa Practice Advisor

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

The Impact Of Eliminating The State And Local Tax Deduction Report